Starting a new business can be an exciting and challenging endeavor. One of the most significant challenges that new business owners face is securing the capital needed to get their business off the ground. A business loan can be a great option for new businesses to obtain the funds they need to cover expenses, expand, and stabilize their operations.

One of the primary advantages of a business loan is that it provides working capital. Working capital is the money a business needs to cover day-to-day expenses, such as rent, inventory, and payroll. With enough working capital, a new business can continue to operate, even if it takes time to generate revenue.

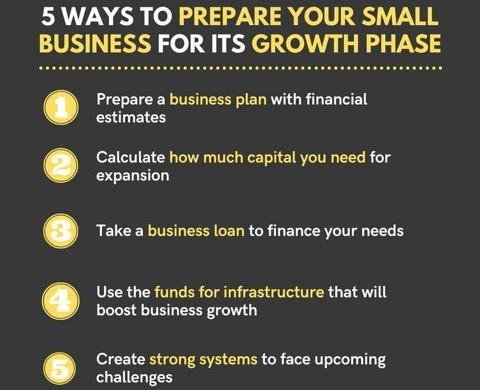

Another benefit of a business loan is that it can fund expansion. By securing a loan, a new business can open new locations, purchase new equipment, and hire additional staff. Expanding a business can help increase revenue and improve the chances of success.

A business loan can also help a new business improve cash flow. Positive cash flow means that a business has more money coming in than going out, which can help cover expenses and invest in growth. A business loan can help improve cash flow by providing the necessary funds to cover short-term expenses and invest in long-term growth.

Building credit is another benefit of a business loan. A new business may have limited credit history, and taking out a business loan and repaying it on time can help establish a positive credit history. This can make it easier to secure future loans and credit lines, which can help a business grow.

Taking advantage of opportunities is also a benefit of a business loan. For example, a new business may have an opportunity to purchase inventory at a discount or take on a new client, but may not have the funds to do so. A business loan can provide the necessary funds to take advantage of these opportunities and help the business grow.

Finally, a business loan can help stabilize a business. If a new business experiences a temporary downturn or unexpected expenses, a business loan can help weather the storm and keep the business going. This can be especially important in the early stages of a business when a significant cash reserve may not be available.

In conclusion, a business loan can be a valuable tool for new businesses. It can provide the necessary funds to cover expenses, expand, and stabilize operations. However, it’s essential to carefully consider the terms and conditions of any loan and ensure that it’s a good fit for the business’s needs and financial situation. By taking advantage of the benefits of a business loan, a new business can increase its chances of success and growth.