Empower Your Business with SBA Loans

Advance Your Business with Tailored SBA Loan Solutions

GET STARTED HERE

Our Mission at Advance American Funding

Comprehensive SBA Loan Services

SBA 7(a) Loan Program

SBA 504 Loan Program

SBA Microloan Program

Business Term Loans

Business Line of Credit

Invoice Factoring

Merchant Cash Advances

Equipment Financing

Working Capital Loans

Debt Refinancing Solutions

Expansion Financing

Real Estate Loans

Start-Up Business Loans

Franchise Financing

Export Financing

Why Choose Us

Our Key Advantages

Tailored Financial Solutions

Competitive Interest Rates

Expert Guidance

Flexible Loan Terms

Fast Approval Process

Trusted Partnerships

Examples

SBA 504 Loan Program

- Type: Restuarant in New Hampshire

- Amount: $350,000 Approved

- Term: 5 Years

- Result: Refinance outstanding debt on business, and obtain Working Capital.

SBA 7(a)

- Type: HVAC Company in Florida

- Amount: $900,000

- Term: 10 Years

- Result: Purchased an additional warehouse in order to expand their market footprint

Insights and Updates

5 Key Strategies to Prepare your Business for Success

Attention Small Business Owners! Are you ready to take your business to the next level? Get prepared for growth with these 5 key strategies: Create a solid business plan to outline your goals and strategies for success. Build a strong team to support your growth and...

Equipment Loan Uses

Are you ready to take your business to the next level? With Advance American Funding's equipment loans, the possibilities are endless! Whether you're looking to purchase new state-of-the-art machinery to improve your manufacturing processes, upgrade your computer...

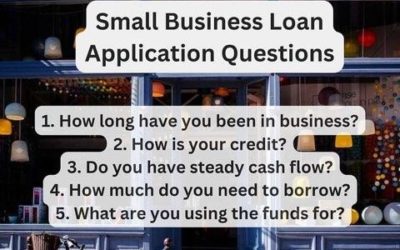

5 Common Questions that may be asked during a Small Business Loan Application

Unlock the potential of your small business with our easy and stress-free loan application process. We're here to help you access the funds you need to reach your goals and succeed. Here's what we need from you: Give us a glimpse of your business: Share the name and...